Pharma Industry Data Consumption

User Interviews & Journey Mapping

How do small, mid-size and large pharmaceutical companies consume and use data and insights?

Our client wanted to understand data use in order to brainstorm a potential data delivery model.

This project was completed with another agency, and, due to an agreement, the name of the end client’s name — a global health organization — cannot be disclosed.

Project Approach

Approach

As part of the user research, we were asked to conduct up to 25 user interviews following stakeholder interviews and an extensive review of prior research provided by the client.

While the client had a general understanding of the user types they wanted to learn from — which included payors and pharmaceutical companies — they struggled to provide us with a clear persona.

The previous research was primarily market research, and the client needed to understand data consumption habits within the target industries. So we decided to focus on individuals in mid-manager or front-line data roles.

I focused on interviews with pharmaceutical roles, conducting 15 60-minute interviews over 3 weeks.

Outcomes

My ah-ha moment came during the interview synthesis when I realized that consumption patterns had less to do with role than they did with the overall data maturity of the organization.

I identified three levels of data maturity:

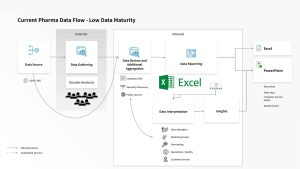

- Low-maturity

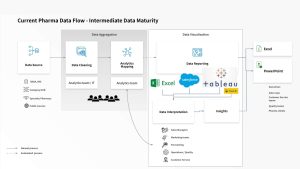

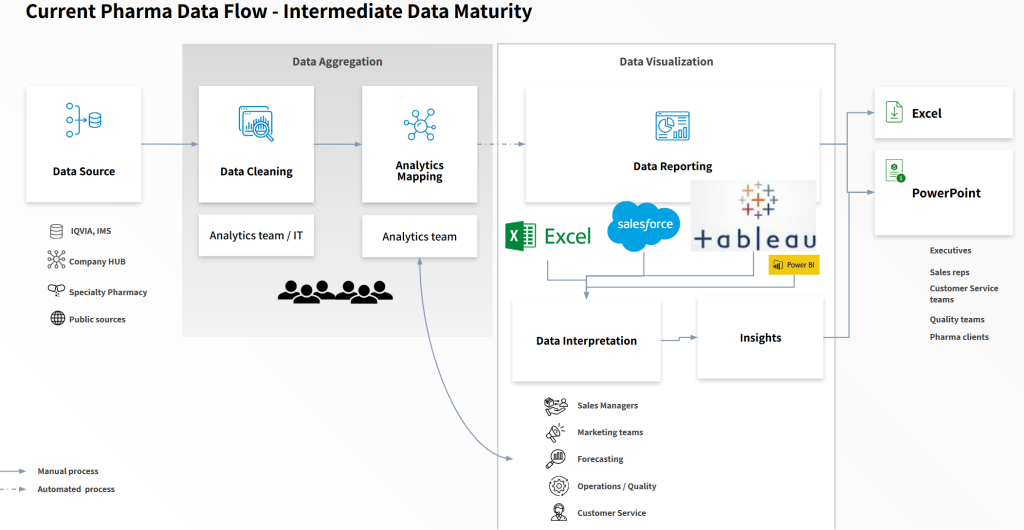

These companies often use outside vendors to aggregate data and use basic tools for developing insights, if at all. - Intermediate maturity

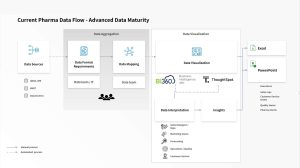

These companies recognize the downsides of outside aggregation and have started to pull data aggregation in-house. They are still working toward a comprehensive data consumption model. - Advanced maturity

These companies have implemented advanced tools for in-house data organization.

Impact

The research I delivered was compiled with payor research and presented to the client.

We recommended to the client to focus on these opportunities:

- Data portal

- Connectors

- API integrations

The client was open to the feedback and realized that our recommendations did not align with their expectations of what potential customers would want.

The research was used as foundation for a series of brainstorm sessions intended to decide a data consumption product the client could build.

Lessons Learned

The client experienced a restructuring and round of layoffs shortly after the conclusion of the research study and report. They ended the design portion of the project.

This was an intense project for several reasons:

- The client wasn’t sure what they wanted to build, despite extensive market research.

- I had to learn about the client’s industry and data extremely quickly in order to ask deeper questions and develop insights.

- The stakeholders didn’t seem aligned and some of them appeared to be less engaged with the research findings.

I found my interviews were rich with information because I leaned into curiosity, and I didn’t pretend to be an expert. While I wanted to sound smart and ask good questions, I was worried that if I didn’t sound genuine the interviewees were less likely to open up to my questions.

Business Inquiries:

[email protected]

Interested in working with me or my company? Standard Beagle is a UX agency providing UX strategy, user research, and product design.

Reach out through my business email and visit our website at standardbeagle.com.